Insights

US Beer and Cider Market in Flux

The US beer industry is in the midst of a major transformation, with the pending merger of AB InBev and SABMiller sorting itself out.

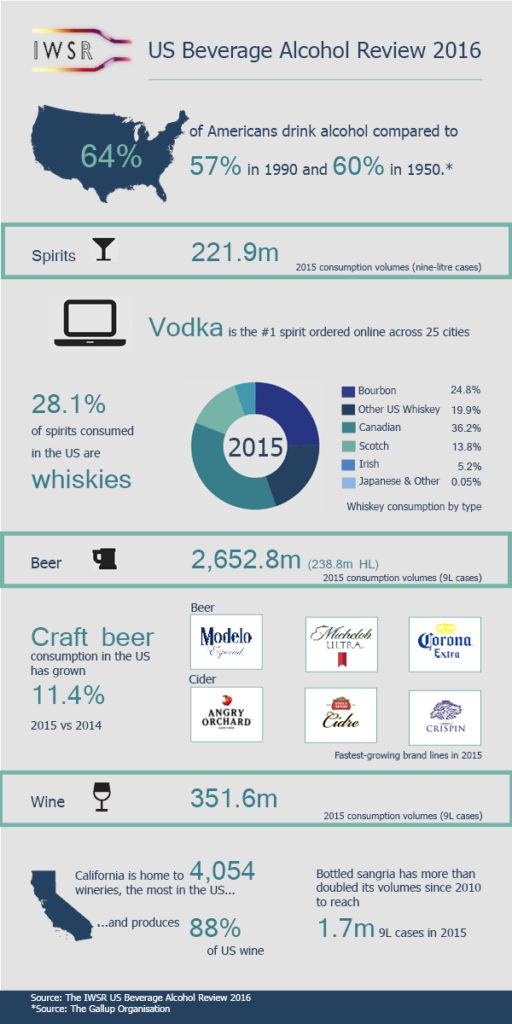

As domestic beers decline, imports, craft, cider and hard sodas are showing growth according to the IWSR’s 2016 US Beverage Alcohol Review. The US beer industry is in the midst of a major transformation, with the pending merger of AB InBev and SABMiller sorting itself out. While speculation on the ramifications of that deal is rife, other aspects of the industry are changing. In 2015 the US beer industry posted a modest gain of 0.4%, ending the year at 247,300 hectolitres (or 202.5m barrels).

The year was filled with big domestic beer brands like Budweiser and Miller struggling to remain relevant to today’s consumers. The domestic regular beer category experienced its fourth year of consecutive declines in 2015 (-3.2%), while the domestic light category lost -2.4% of its volume last year. Imported beers, especially from Mexico, experienced unprecedented growth levels, led by Corona and Modelo. The imported beer segment advanced volumes by 6.9% in 2015 – a testament to category performance of the top five leading brands, which make up nearly 70% of the category.

The US cider category grew by double digits once again in 2015, albeit at a slower rate than previous years. The 14.7% advancement, although significant, was a far cry from the 64% growth the category experienced in 2014. From a brand perspective, Angry Orchard remained the category leader in 2015, with a cider market share of 51.4%. The future of hard cider market in the US is positive. Consumers are now trading up to higher-end offerings like imports and craft-style hard ciders from local producers. The average supermarket has 17 cider SKUs and the base is growing at 15%. However, the cider category hasn’t gone through the entire process of discontinuing underperforming line extensions due to inventory levels. As a point of reference, craft beers discontinue 20% of their SKUs a year, while FABs discontinue 35% of their SKUs, so a shake-out among lower-end cider brands is expected. For more information on the IWSR’s 2016 US Beverage Alcohol Review, please contact Brandy Rand, VP US marketing and business development at brandy@theiwsr.com The above article was contributed by our data partner The IWSR Magazine August Issue

Event Producer

Beverage Trade Network USA Trade Tasting is brought to you by Beverage Trade Network, the leading online platform dedicated to connecting the global beverage industry. Beverage Trade Network (BTN) successfully connects wineries, breweries, distilleries and brand owners with international importers, distributors, brokers and beverage industry professionals on a daily basis. Strong partnerships with international and US organizations have helped BTN establish USA Trade Tasting as a premiere sales and marketing event committed to connecting the beverage industry.

Become a USATT exhibitor and grow your distribution in the USA. Meet importers, distributors, retailers and press. Get exhibitor information here.